Gas Transportation and Marketing

Updated strategic gas initiatives

Updated strategic gas initiatives In 2019, KMG refreshed its strategy for gas transportation and marketing, adding three more initiatives to its key initiative of gas exports to China.

To fully unlock its gas transportation potential and boost the share of exports and transit fees in KMG’s revenues, the Company has focused on:

- Gas exports to China

The expansion of the Beineu-Bozoi-Shymkent and Kazakhstan-China trunk gas pipeline capacity enables KMG to increase stable export supplies of commercial gas to China up to 10 bln m3 per year starting from 2019 and beyond. - Exports of gas products

KMG is considering the construction of facilities to produce high value-added gas products for domestic and export sales. - Ensuring efficient use of gas in the domestic market

KMG will continue engaging government authorities to ensure efficient gas consumption in the domestic market. - Enhancing transit potential

KMG will continue to focus on maximising profitability of transit flows from neighbouring countries leveraging its advantageous position between the expanding major markets of China and Russia.

KMG prioritises meeting the consumer needs reliably and efficiently and diversification of gas sales markets. The throughput capacity of the gas transportation infrastructure has been aligned with the potential growth of gas production in the country. With timely investments into the gas transportation system, KMG has been able to supply the country’s regions with natural gas and grow the potential of export supply routes. KazTransGas JSC, KMG’s wholly-owned subsidiary, is the operator of our gas transportation system.

Gas pipeline infrastructure

KazTransGas JSC is Kazakhstan’s national gas and gas supply operator.

KazTransGas operates the centralised infrastructure for commercial gas transportation via trunk pipelines and gas distribution networks, supports international transit and marketing of gas on the domestic and foreign markets, as well as designs, finances, builds and operates gas pipelines and gas storage facilities.

KazTransGas operates the largest trunk gas pipeline network in Kazakhstan with a total length of 19,146 km and an annual capacity of 230 bln m3, as well as gas distribution networks with a length of over 49 thous. km.

KazTransGas operates three underground gas storage facilities (Bozoy, Akyrtobe, and Poltoratskoye) in Kazakhstan with a total working gas capacity of up to 4.6 bln m3. Gas transportation is supported by 40 compressor stations and 232 gas pumping units.

KazTransGas has subsidiaries in Kazakhstan in the following business segments:

- Trunk pipeline gas transportation

- Intergas Central Asia JSC, KazTransGas’ wholly-owned subsidiary

- Asia Gas Pipeline LLP, KazTransGas’ 50%-owned subsidiary

- Beineu-Shymkent Gas Pipeline LLP, KazTransGas’ 50%-owned subsidiary

- Transportation via gas distribution systems

- KazTransGas Aimak JSC, KazTransGas’ wholly-owned subsidiary

- Gas and condensate production

- Amangeldy Gas LLP, KazTransGas’ wholly-owned subsidiary (see the Production section for production data).

| Company | Trunk gas pipeline | Length, km | Capacity, bln m3 per year |

|---|---|---|---|

| ICA | Soyuz, Orenburg-Novopskov | 1,147 | 68.4 |

| Central Asia-Center | 5,306 | 50.8 | |

| Bukhara-Ural | 2,382 | 31.5 | |

| BGR-TBABukhara gas-bearing region - Tashkent-Bishkek-Almaty., Gazli-Shymkent | 2,462 | 10.2 | |

| Akshabulak-Kyzylorda | 123 | 0.4 | |

| SaryarkaSaryarka trunk gas pipeline was leased to ICA, but is owned by AstanaGaz KMG JSC, shareholders of which are Samruk-Kazyna JSC (50%) and Baiterek Venture Fund JSC (50%). | 1,061 | 2.2For the 1st stage of the gas pipeline, the design and actual capacity is 2.2 bln m3 per year. | |

| AGP | Kazakhstan-China | 3,916 | 55 |

| BSGP | Beineu-Bozoi-Shymkent | 1,454 | 13Actual capacity - 13 bln m3 per year, design capacity - 15 bln m3 per year. |

Investment projects

Increasing the capacity of Beineu-Bozoy-Shymkent trunk gas pipeline up to 15 bln m3 per year

The construction of the Beineu-Bozoy-Shymkent trunk gas pipeline was started in 2011. In 2019, the following activities were carried out to increase capacity to 15 bln m3 per year:

- The Korkyt-Ata, Aral and Turkestan compressor stations were commissioned. The gas pipeline capacity at the Bozoy-Shymkent section was increased to 13 bln m3 per year

- Design and estimate documentation was developed and core equipment for the construction of the fourth compressor station “1A” on the Beineu-Bozoi section is being procured, scheduled for completion in 2020

- For the expansion of the existing compressor station Bozoi, and Akbulak and Beineu gas metering stations the feasibility study was carried out and design and estimate documentation was finalized and approved.

Reconstruction of the Bozoy underground gas storage facility

In order to smooth out seasonal unevenness in gas consumption and to ensure stable gas supplies to the domestic market and export, ICA is reconstructing the Bozoy underground gas storage facility. Within the project to improve the quality of the gas, to purify it from mechanical impurities and moisture, it was retrofitted with a modern gas drying unit. The work carried out will help to increase the reliability and safety of the gas storage, as well as to increase the daily productivity of gas extraction and injection to the projected 27 mln m3 per day. It is expected that the projected gas storage volume of 4 bln m3 will be achieved in 2020.

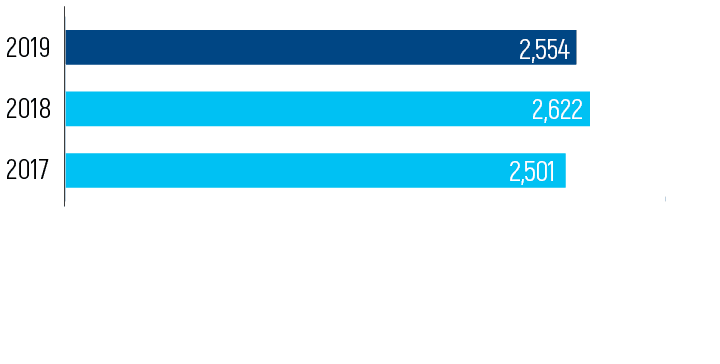

Trunk pipeline gas transportation

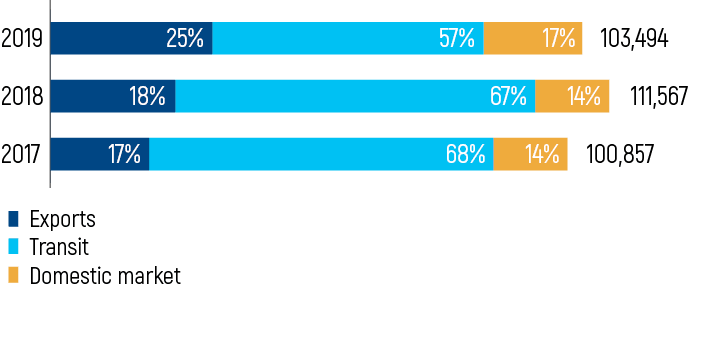

The volume of gas transportation via KMG’s main pipelines declined in 2019 by 7.2% to 103,494 mln m3 mainly due to a decrease in gas transit following the reallocation of Russian gas flows by Gazprom and lower Central Asian gas transit volumes to China.

Intergas Central Asia JSC

Intergas Central Asia is a wholly-owned subsidiary of KazTransGas. In 2018, ICA received the status of the National Gas Pipeline Operator.

Today, ICA carries out internal transportation and transit of natural gas within the territory of Kazakhstan through gas pipelines with a total length of 19,146.51 km.

ICA operates 3 underground gas storages (UGS):

- Bozoyskoye UGS facility in the Aktobe region

- Poltoratskoe UGS in the South Kazakhstan region

- Akyrtobinskoye UGS in the Zhambyl region.

Intergas Central Asia’s core businesses:

- gas transportation to the domestic market of the Republic of Kazakhstan

- transit transportation of gas from Turkmenistan and Uzbekistan to Russia via Kazakhstan

- transportation of gas for export

- transit transportation of gas from one part of Russia to another via Kazakhstan

- transit transportation of Uzbekistan’s gas to supply Tashkent.

Asia Gas Pipeline LLP

Asia Gas Pipeline is a 50/50 joint venture between KazTransGas JSC and Trans-Asia Gas Pipeline Company Ltd. (shareholder – CNODC, a subsidiary of CNPC). The joint venture was established to finance, construct and operate a section of the Kazakhstan-China gas pipeline designed to transport natural gas from the Kazakhstan-Uzbekistan border to the Khorgos gas metering station in China.

The purpose of the project is to facilitate the transit of Turkmen and Uzbek gas to China, exports of Kazakh gas to China, as well as uninterrupted gas supply to southern regions of Kazakhstan.

The length of the gas pipeline within Kazakhstan is 2,612 km for Strings A and B, and 1,304 km for String C. The total throughput capacity of the gas pipeline is 55 bln m3 per year (30 bln m3 Strings A and B, 25 bln m3 String C).

In 2018, the project “Increasing the capacity of the Kazakhstan-China gas trunk pipeline” (String C) was completed. As a result, the productivity of the Kazakhstan-China trunk pipeline was increased to 55 bln m3 per year.

The project “Increasing the productivity of strings A and B to 40 bln m3 per year” is under the study. It is expected that the project will allow to increase the total productivity of the gas pipeline to 65 bln m3 per year.

Beineu-Shymkent Gas Pipeline LLP

Beineu-Shymkent Gas Pipeline LLP is a 50/50 joint venture between KazTransGas JSC and Trans-Asia Gas Pipeline Company Ltd. (shareholder – CNODC, a subsidiary of CNPC). The project is of paramount strategic importance to the Republic of Kazakhstan, as it supplies the natural gas needs of Kazakhstan’s southern regions, enables diversification of Kazakhstan’s gas exports, ensures energy security of the country, and builds a unified gas transportation system.

The Beineu-Bozoy-Shymkent trunk gas pipeline is the second section of the Kazakhstan-China gas pipeline. The gas pipeline connects the western oil and natural gas fields with the southern regions of the country, as well as with the gas pipelines of the Bukhara gas-bearing region, the Tashkent-Bishkek-Almaty gas pipeline, the Gazli-Shymkent gas pipeline and string “C” of the Central Asia-China gas pipeline. The actual length of the Beineu-Shymkent gas pipeline is 1,454 km and capacity is 13 bln m3 per year.

Gas Distribution and Expansion of Gas Infrastructure in Kazakhstan’s Regions

KazTransGas Aimak JSC

KazTransGas Aimak is a wholly-owned subsidiary of KazTransGas. KazTransGas Aimak is the largest gas distributor in Kazakhstan, operating 50.6 thous. km of distribution and trunk gas pipelines in all ten regions and two cities of national significance connected to the gas grid.

The key objectives of KazTransGas Aimak:

- ensuring commercial gas supplies

- transportation of gas via distribution networks

- management of gas transportation assets in the regions.

Gas distribution and gasification projects in the regions of Kazakhstan

Upgrade of the gas distribution network in Taraz

Since its launch in 2011, the project has replaced about 899 km of low-pressure steel gas pipelines (37 km in 2019) with polyethylene medium-pressure gas pipelines in the private sector for 42 thous. customers, resolving the problem of inadequate gas pressure for consumers. As a result, the throughput of the gas supply system has increased 1.5 times to 150.5 thous. m3 per hour.

Upgrading, retrofitting and expanding the gas distribution networks supplying communities in Mangystau Region

Since its launch in 2015, the project has constructed or upgraded 1,347 km of gas pipelines (25 km in 2019), and installed 6 automated gas distribution stations, 34 gas control units, and 45 gas control modules. As a result, five settlements were connected to the gas grid, with 2,500 new customers getting access to gas.

Expanding gas infrastructure in Almaty, retrofitting and upgrading the city’s gas distribution systems

The project will allow the connection of about 4.1 thous. new customers with an average annual gas consumption of 15.8 mln m3. On January 1, 2020 265 km (170 km in 2019) of new gas pipelines were built, 76 km (34 km in 2019) of existing pipelines were reconstructed, 21 cabinet gas control points, 1 gas control block point were installed.

Construction of the Saryarka trunk gas pipeline

In October 2019, the construction of Phase 1 of the Saryarka trunk gas pipeline was completed, and in December of the same year the Commissioning Act was signed. In February 2020, the gas pipeline was leased out to Intergas Central Asia JSC, which will be responsible for gas transportation. Saryarka trunk gas pipeline is owned by AstanaGaz KMG JSC, shareholders of which are Samruk-Kazyna JSC (50%) and Baiterek Venture Fund JSC (50%). The throughput capacity of Phase 1 of the pipeline is up to 2.2 bln m3 per year. The total length of the gas pipeline is 1,060.6 km. The gas pipeline will ensure stable gas supplies to the central regions and the capital of Kazakhstan, totalling about 2,710 thous. people. The Saryarka trunk gas pipeline will facilitate transition to an affordable, greener fuel, natural gas, significantly improving the overall environmental situation in the country.

NGV Infrastructure

KazTransGaz Onimderi LLP

In 2019, KazTransGaz Onimderi together with KazTransGas continued to implement initiatives in Kazakhstan’s regions under the 2019–2022 Action Plan to expand the use of natural gas as a motor fuel, approved by Resolution No. 797 of the Government of the Republic of Kazakhstan dated 29 November 2018 (the “Action Plan”) and the Concept of Kazakhstan’s transition to a green economy. These efforts focused on converting motor vehicles to a more environmentally friendly and efficient type of motor fuel instead of conventional fuels for vehicles such as petrol or diesel. The main consumers of compressed natural gas (CNG) will be city bus fleets, long-haul vehicles, private passenger fleets, trucks and cars of the regional branches of KazTransGas subsidiaries, as well as private vehicles.

Development of a project for the use of natural gas as a motor fuel

Land plots were allocated for the construction of CNG filling stations in Almaty and Shymkent, and in the Aktobe, Turkestan, Mangistau, Kyzylorda, Atyrau and Almaty Regions. CNG-fuelled city passenger buses hit the roads in Aktobe (78 buses), Almaty (400 buses), Shymkent (200 buses), and Kyzylorda (120 buses). Plans for 2020 also include purchasing 960 more CNG buses for Shymkent (590), Almaty (200), and Atyrau (170).

Under the memorandum of cooperation signed between Gazprom, CNPC and KMG to develop production and marketing infrastructure supporting the use of natural gas as a motor fuel along the Europe–Western China international transport corridor route, market research was continued on vehicle traffic intensity and the related LNG/CNG consumption volumes, along with the review and analysis of existing technologies, and estimation of the infrastructure capacity and capital requirements.

A memorandum of cooperation was signed with the national road operator NC KazAvtoZhol JSC to develop production and marketing infrastructure supporting the use of CNG as a motor fuel in the Republic of Kazakhstan. Five land plots have already been approved and fully permitted for use along the international transport corridor route (in Kazalinsk, Irgiz, Aralsk, Karabutak, and Kazygurt).

798 buses are running on KMG's gas and motor fuel.

Digitalisation

From 2017 to 2023, we are running a project to roll out an analytical geographic information system covering gas pipeline facilities which analyses digital spatial data on gas transportation system facilities, and presents their spatial position and information on their technical and operational parameters.

In 2019, Amangeldy Gas LLP rolled out the 1C: Maintenance Management IT solution. The solution provided visibility and transparency into the maintenance and repair process, as well as streamlined hierarchical storage of equipment data and offered access to the process to all stakeholders. As the next step, the 1C: Maintenance Management solution was integrated with 1C: Accounting, resulting in linking inventory costs by equipment of both systems.

To prevent unauthorized air emissions, and protect the life and health of consumers, KazTransGaz Onimderi purchased four auto labs based on Toyota Hilux vehicles, equipped with PERGAM digital sensors to detect methane leaks. As of the writing of this report, the labs have detected 235 leaks in residential premises and social facilities, with the total number of leaks detected running into 8,766.

Gas Marketing

As the national gas and gas supply operator, KazTransGas exercises the government’s preemptive right to purchase raw and/or commercial gas from subsoil users/suppliers.

In accordance with the law, subsoil users send a commercial offer to the national operator, indicating the volumes, price and delivery point for the proposed supply of raw and/or commercial gas. The national operator uses its own judgement to decide whether to exercise or waive the government’s preemptive right.

Currently, the national operator exercises the government’s preemptive right to acquire gas from the following companies with KMG interest:

- Embamunaigas JSC (100%)

- JV Kazgermunai LLP (50%)

- Kazakhoil Aktobe LLP (50%)

- Kazakhturkmunay LLP (100%)

- KazMunayTeniz LLP (100%)

The gas supplied by the above companies is marketed in the domestic market.

Companies with a KMG interest that are exempt from the government’s preemptive right to acquire gas:

- Amangeldy Gas LLP (100%)

- KazGPZ LLP (100%)

- Tengizchevroil LLP (20%)

- Karachaganak Petroleum Operating B.V. (10%)

- North Caspian Operating Company N.V. (8.44%)

The above companies all sell gas domestically and for export.

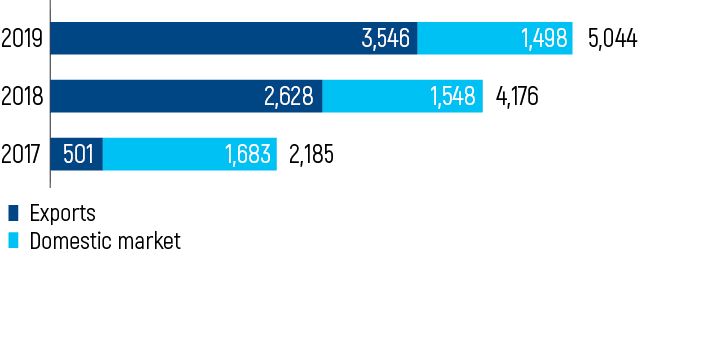

Commercial gas sales volumes in 2019 were 22,834 mln m3, with 8,806 mln m3 of gas exported, of which 81% were sent to China under a signed sales and purchase agreement to export gas to China.

| Indicator | 2017 | 2018 | 2019 |

|---|---|---|---|

| Gas purchase volumes | 18,153 | 23,297 | 24,200 |

| Kazakhstan subsoil users / suppliers | 13,376 | 17,209 | 16,435 |

| Companies with KMG participation | 6,446 | 10,195 | 9,537 |

| Third parties | 6,930 | 7,014 | 6,898 |

| Gas imports | 4,777 | 6,088 | 7,765 |

| Russia | 3,038 | 3,216 | 5,054 |

| Uzbekistan | 1,739 | 2,872 | 2,710 |

| Gas sales by KazTransGas | 2017 | 2018 | 2019 |

|---|---|---|---|

| Exports | 4,949 | 8,917 | 8,806 |

| Russia | 2,073 | 2,350 | 1,000 |

| Kyrgyzstan | 249 | 275 | 264 |

| China | 1,003 | 5,484 | 7,091 |

| Uzbekistan | 1,624 | 807 | 452 |

| Domestic market | 12,793 | 13,999 | 14,028 |

| Total gas sales | 17,742 | 22,915 | 22,834 |