Downstream

Following the completion of the modernisation programme, which has enabled the Company’s oil refineries in Kazakhstan and Romania to achieve higher refining depths, the key objectives for these assets in line with the 2018–2028 Strategy include:

- for Kazakhstan refineries: to ensure adequate liquidity generation through cost optimisation to be able to timely meet liabilities as they fall due

- for Petromidia Refinery: to improve performance by streamlining production processes, including through digitisation and oil product slate optimisation to increase sales margins, and ensure a steady dividend flow to the KMG Corporate Centre.

Oil and condensate marketing

In 2019, sales of own oil and condensate produced by KMG amounted to 23,509 thous. tonnes, including 16,379 thous. tonnes of oil exports, and 7,130 thous. tonnes of domestic oil supplies. Supplies to KMG refineries in Kazakhstan are fully included into domestic oil supplies: 2,994.82 thous. tonnes to Atyrau Refinery, 3,158.95 thous. tonnes to Pavlodar Refinery, 517.81 thous. tonnes to Shymkent Refinery, and 448.56 thous. tonnes to Caspi Bitum.

| Asset | 2017 | 2018 | 2019 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Exports | Domestic market | Total | Exports | Domestic market | Total | Exports | Domestic market | Total | |

| Operating assetsOzenmunaigas, Embamunaigas, Karazhanbasmunai, Kazgermunai, PetroKazakhstan, Kazakhturkmunay, Kazakhoil Aktobe, Mangistaumunaigaz. | 9,727 | 6,169 | 15,896 | 8,773 | 6,980 | 15,752 | 8,472 | 7,120 | 15,592 |

| — including subsidiariesOzenmunaigas, Embamunaigas, Kazakhturkmunay | 5,922 | 2,687 | 8,607 | 5,367 | 3,303 | 8,670 | 5,325 | 3,453 | 8,778 |

| Mega projectsKMG Kashagan B.V., KMG Karachaganak, Tengizchevroil LLP. | 7,525 | 3 | 7,529 | 7,971 | 12 | 7,983 | 7,907 | 10 | 7,917 |

| TOTAL | 17,252 | 6,173 | 23,424 | 16,744 | 6,991 | 23,735 | 16,379 | 7,130 | 23,509 |

KMG refining assets

Within KMG’s asset mix, four refineries in Kazakhstan and two in Romania are responsible for processing liquid hydrocarbons (primarily oil).

| Indicator | Kazakhstan refineries | Romania refineries | ||||

|---|---|---|---|---|---|---|

| Atyrau Refinery | Pavlodar Refinery | Shymkent Refinery | Caspi Bitum | Petromidia | Vega | |

| Location | Atyrau | Pavlodar | Shymkent | Aktau | Navodari | Ploiesti |

| Commissioning date | 1945 | 1978 | 1985 | 2013 | 1979 | 1905 |

| Refining design capacity, mln tonnes | 5.5 | 6.0 | 6.0 | 1.0 | 6.0Design capacity includes refining 5 mln tonnes of oil and 1 mln tonnes of other hydrocarbons per year. | 0.5 |

| Hydrocarbon refining volumes in 2019, mln tonnes | 5.4 | 5.3 | 5.4 | 0.89 | 6.33Total refining volume of 6.33 mln tonnes includes 5.43 mln tonnes of crude oil and 0.9 mln tonnes of other and alternative feedstocks. | 0.44 |

| Refinery utilisation rate in 2019 | 98 | 88 | 90 | 89 | 97.5Petromidia Refinery’s utilisation rate is 97.5% as per Solomon Associates methodology. | 132 |

| KMG interest | 99.53 | 100 | 49.72 | 50 | 54.63 | 54.63 |

| Nelson Index | 13.9 | 10.5 | 8.2 | – | 10.5 | – |

| Light product yield in 2019 | 59 | 69 | 76 | – | 86.01 | – |

| Refinery co-owners | – | – | CNPC | CITIC | Romanian Government | Romanian Government |

Atyrau Refinery was built in 1945, with Pavlodar Refinery coming online in the 1970s. Shymkent Refinery was commissioned in the mid-1980s, while Caspi Bitum was launched in 2013 to support the development of a modern refining sector in Kazakhstan.

In 2007, KMG purchased Rompetrol Group, which incorporates the Petromidia Refinery (the largest refinery in Romania) and the Vega Refinery (the only extraction naphtha producer in Central and Eastern Europe). The company has since been renamed KMG International.

In 2019, the following projects were implemented under the strategy:

- The utilisation of new capacities resulting from the modernisation of three oil refineries (Atyrau Refinery, Pavlodar Refinery, and Shymkent Refinery) allowed KMG to fully meet domestic demand for oil products. The potential oil refining output of the refineries increased to 18.5 mln tonnes per year, and the refining depth grew by 10% to reach 90%. Kazakhstan’s domestic consumers were fully self-sufficient in fuels and lubricants (K4, K5). 37 thous. tonnes of petrol were exported

- Pavlodar Refinery is making progress on its Yertis project, which will allow for the production of winter diesel fuels with a cloud point of –32°C or lower

- The output of petrochemicals (benzene and paraxylene) at the Atyrau Refinery LLP increased to 145 tonnes (+ 445%)

- A record output of bitumen was achieved at JV Caspi Bitum LLP, with 369 thous. tonnes of bitumen produced, fully covering domestic market needs.

Tariff policy

Kazakhstan refineries only offer oil refining services using the set tariffs and do not purchase oil for refining or sell refined oil products. Oil suppliers sell finished oil products independently. The refineries focus exclusively on production issues, streamlining refining activities and reducing costs.

Oil refining tariffs at Kazakhstan refineries factor in actual production-related operating expenses and an investment component (capital expenditures to maintain current production rates, modernisation loans).

According to the Law On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan Concerning Entrepreneurship in Kazakhstan dated 29 October 2015, from 1 January 2017 the Government no longer regulates refining prices, which has significantly simplified the process for agreeing oil refining tariff changes, which are currently coordinated by the Ministry of Energy of the Republic of Kazakhstan.

- The tariff for refining 1 tonne of oil at Shymkent Refinery was revised twice: from 1 July from 22,500 KZT (net of VAT) to 24,750 KZT (net of VAT), and from 1 October to 28,059 KZT (net of VAT).

- On 3 December 2019, Deputy Energy Minister of the Republic of Kazakhstan A. M. Magauov approved the tariff for oil refining at Pavlodar Refinery LLP at 20,904 KZT (net of VAT) from 1 January 2020.

| Weighted average tariffs of refineries, KZT per tonne | 2017 | 2018 | 2019 |

|---|---|---|---|

| Atyrau Refinery | 23,370 | 33,810 | 37,436 |

| Pavlodar Refinery | 15,429 | 17,250 | 19,805 |

| Shymkent Refinery | 12,809 | 19,579 | 24,485 |

| Caspi Bitum | 16,667 | 18,008 | 18,010 |

The tariff includes an amount which covers operating expenses, capital expenditure and investment expenditure. Investment expenditure is used to repay loans (principal and interest) raised to finance capital-intensive refinery modernisation projects.

Refining volumes at Kazakhstan refineries

In 2019, hydrocarbon refining volumes at Kazakhstan refineries (net to KMG) amounted to 13,822 thous. tonnes, or 288 thous. barrels per day. In 2019, refining volumes increased by 438 thous. tonnes, or 3.3% year-on-year, mainly due to a refining volume increase by 335 thous. tonnes, or 14,1%, at Shymkent Refinery resulting from a capacity increase following its modernisation.

| Refinery | 2017 | 2018 | 2019 |

|---|---|---|---|

| Atyrau Refinery | 4,724 | 5,268 | 5,388 |

| Pavlodar Refinery | 4,747 | 5,340 | 5,290 |

| Shymkent Refinery (50%) | 2,343 | 2,366 | 2,701 |

| Caspi Bitum (50%) | 359 | 409 | 443 |

| Total (net to KMG) | 12,173 | 13,384 | 13,822 |

Oil product output in Kazakhstan

In 2019, the oil product output (net to KMG) increased by 361 thous. tonnes, or 3.0% year-on-year, to 12,513 thous. tonnes of finished products due to a refining volume increase at Shymkent Refinery resulting from a refining capacity increase following its modernisation. In 2019, light product yield was 64% compared to 61% in 2018. In 2019, KMG fully covered domestic market demand for light products.

Increased light product yields were a key driver of change across Kazakhstan’s three largest refineries, boosting the value of hydrocarbon product slates. These changes resulted from the modernisation programme at Kazakhstan refineries.

| Oil products | 2017 | 2018 | 2019 |

|---|---|---|---|

| Atyrau Refinery | 4,481 (100%) | 4,742 (100%) | 4,852 (100%) |

| LightIncluding petrol, diesel fuel, and jet fuel. | 2,020 (45%) | 2,691 (57%) | 2,850 (59%) |

| DarkIncluding fuel oil, vacuum gas oil, and bitumen. | 2,236 (50%) | 1,589 (34%) | 1,580 (33%) |

| PetrochemicalsIncluding benzene and paraxylene. | 8 (0.2%) | 32 (0.7%) | 145 (3%) |

| Other | 217 (4.8%) | 430 (9%) | 277 (6%) |

| Pavlodar Refinery | 4,262 (100%) | 4,855 (100%) | 4,746 (100%) |

| Light | 2,695 (63%) | 3,243 (67%) | 3,271 (69%) |

| Dark | 973 (23%) | 1,007 (21%) | 898 (19%) |

| Other | 594 (14%) | 605 (12%) | 576 (12%) |

| Shymkent Refinery (50%) | 2,195 (100%) | 2,151 (100%) | 2,476 (100%) |

| Light | 1,258 (57%) | 1,422 (66%) | 1,881 (76%) |

| Dark | 887 (40%) | 644 (30%) | 447 (18%) |

| Other | 49 (2%) | 85 (4%) | 148 (6%) |

| Caspi Bitum (50%) | 353 (100%) | 405 (100%) | 438 (100%) |

| Total (net to KMG) | 11,291 | 12,152 | 12,513 |

Production and marketing of oil products derived from KMG’s own oil

KMG’s operating assets Ozenmunaigas, Embamunaigas and Kazakhturkmunay supply Atyrau and Pavlodar Refineries, and the resulting oil products are subsequently sold wholesale domestically and for export.

In 2019, Ozenmunaigas, Embamunaigas and Kazakhturkmunay supplied 3,453 thous. tonnes of oil for refining, including 2,322 thous. tonnes to the Atyrau Refinery and 1,131 thous. tonnes to the Pavlodar Refinery. The two refineries’ combined output for the year was 3,114 thous. tonnes of oil products, including 1,892 thous. tonnes of light products, 878 thous. tonnes of dark products, 63 thous. tonnes of petrochemicals, and 281 thous. tonnes of other oil products.

| Oil products | Atyrau Refinery | Pavlodar Refinery | Total | Average oil product wholesale prices over 12M 2019, KZT per tonne |

|---|---|---|---|---|

| Light | 1,207 | 685 | 1,892 | 160,851 |

| Dark | 686 | 192 | 878 | 105,131 |

| Petrochemicals | 63 | 0 | 63 | 224,851 |

| Other | 119 | 162 | 281 | 38,341 |

| Total | 2,074 | 1,039 | 3,114 | 137,001 |

KMG sells oil products wholesale after the oil purchased from Ozenmunaigas, Embamunaigas and Kazakhturkmunay is refined at the Atyrau and Pavlodar Refineries. In 2019, KMG sold 3,136 thous. tonnes of oil products, primarily petrols, diesel fuel and fuel oil (80%).

The bulk of oil products was sold domestically (2,333 thous. out of 3,136 thous. tonnes), and the remainder was exported (804 thous. out of 3,136 thous. tonnes). The ratio of domestic to export oil product supplies was largely flat year-on-year.

In the domestic market, 1,331 thous. tonnes of gasoline and diesel fuel were shipped to the retail chain of filling stations of KMG Onimderi LLP and Petro Retail LLP, 205 thous. tonnes of diesel fuel for agricultural producers, 51 thous. tonnes of fuel oil for heating social and production facilities and institutions, 120 thous. tonnes of gasoline, diesel fuel and jet fuel and 41 thous. tonnes of fuel oil were delivered to KMG Aero LLP to meet the needs of the Single Operator for the supply of light petroleum products and fuel oil for law enforcement agencies, airports and commercial aviation, 585 thous. tonnes of oil products to third parties.

Refining in Romania

In 2007, KMG acquired Rompetrol Group, which incorporates Petromidia Refinery (the largest oil refinery in Romania) and Vega Refinery (the only extraction naphtha producer in Central and Eastern Europe). The company has since been renamed KMG International.

The core business of KMG International is hydrocarbon refining, as well as wholesale and retail sales of oil products. The KMG International-owned Petromidia Refinery is responsible for primary hydrocarbon refining, with the Vega Refinery focusing on secondary refining. The Petromidia and Vega Refineries operate according to the model where refineries purchase hydrocarbons for their own account, refine them and then sell them either wholesale or retail through an owned retail network of filling stations.

KMG International also owns a major petrochemical complex producing polypropylene and low- and highdensity polyethylene (LDPE and HDPE). In addition, KMG Trading AG, the trading subsidiary of KMG International, is focused on trading in crude oil and oil products produced by KMG International refineries or by third parties.

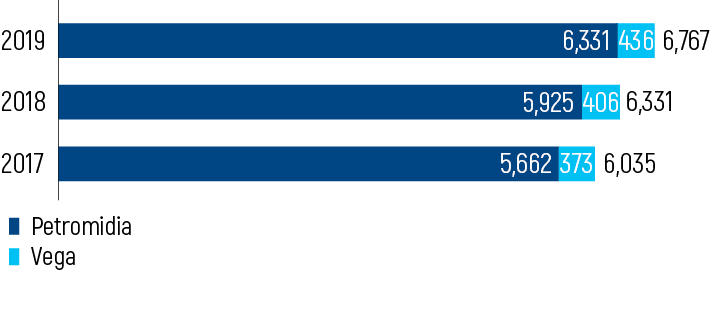

In 2019, our refineries in Romania processed 6,767 thous. tonnes of hydrocarbons and other feedstocks, or 17.3 thous. tonnes per day. Hydrocarbon refining volumes increased by 436 thous. tonnes, or 6.9% year-on-year, largely due to improved feedstock blending and sustained record-high average daily refining rates at the Petromidia Refinery.

Oil products production

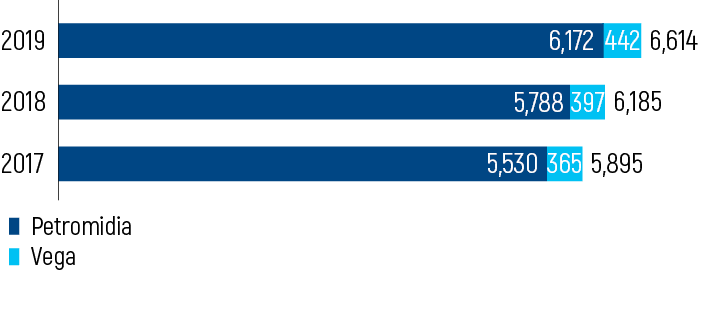

In 2019, oil product output increased by 429 thous. tonnes, or 6.9% year-on-year, to 6,614 thous. tonnes due to improved feedstock blending at the Petromidia Refinery and higher demand in the market.

Petromidia’s refining margin, calculated as the difference between the Urals prices and prices for refined oil products (petrol, diesel fuel, naphtha, liquefied petroleum gas, jet fuel, fuel oil, propylene, sulphur, and oil coke), was USD 4.2 per barrel in 2019, which is USD 2 per barrel lower year-on-year (reflecting the global oil prices).

| 2017 | 2018 | 2019 | |

|---|---|---|---|

| Petromidia refining margin, USD per tonne | 48.8 | 47.4 | 31.7 |

| Petromidia refining margin, USD per barrel | 6.4 | 6.2 | 4.2 |

In 2019, crude oil volumes for resale marketed through KMG International’s trading operations totalled 10.9 mln tonnes.

KMG International’s retail network

At the end of 2019, KMG International’s retail network consisted of 271 gas stations and 693 points of sales across Romania, and 244 gas stations and points of sales elsewhere.

- Romania: 271 gas stations and 693 points of sales (DOEX, RBI and Cuves). The share of the retail market is 16%

- Neighboring countries: 244 gas stations and points of sales. Bulgaria – 56 (retail market share 3%), Georgia – 101 (market share 19.5%), Moldova – 87 DOCO gas stations (market share 24%).

Retail sales (retail and trading) of oil products produced by KMG International increased by 5.5% year-on-year to 3,450 thous. tonnes driven by an increase in the sales of diesel fuel (+ 13%), petrol (+ 11%), and jet fuel (+ 19%).